How to Own Gold: Avoid Gold ETF’s

The best way to own precious metals is outside of the banking system. Because ETF vehicles used for precious metal ownership are integrally tied to this system, they too are another all-too-common, yet clearly inferior approach, to informed precious metal ownership.

For many investors, gold and other metal ETFs are the most convenient instrument for a theoretically simple, immediate and liquid avenue to precious metal ownership. Upon closer examination, however, such instruments, including those vehicles promising direct ownership in physical gold, are ultimately just an investment in a paper promise rather than actual gold and assured delivery. In the end, the holder of the paper has no security in the physical gold.

Total global investment into gold ETFs and gold funds can vacillate wildly based upon the prevailing trends in gold price. In 2020, for example, gold ETFs saw record inflows into what became a $316 billion market representing 4,878 tonnes. Within one year, however, as gold experienced temporary headwinds from a record-high USD, that same industry fell to $191B and 3548 tonnes.

If we compare even the record high ETF levels above to that of the S&P 500’s total market cap of $27 trillion, one quickly sees how relatively small, if not insignificant, this ETF gold market truly is. The top 5 companies in the S&P index, for example, are worth $6 trillion. Apple, with a nearly $200 billion cash pile and some stock, could easily acquire all the gold funds and ETFs. During equity bull markets, one can easily see how small the gold ETF universe truly is. Looking ahead, however, as stock markets race into bear territory and a mean-reverting implosion, the subsequent surge in gold and hence the relative sizes of stocks versus gold will look very different.

Despite such shifting flows and market caps, the simple fact remains that gold and other precious metal ETFs are instruments of speculation and not vehicles for serious and informed gold investors. To illustrate why, let us consider the most popular gold ETF in the current landscape, namely GLD.

The State Street GLD ETF—An Investment in Paper Gold

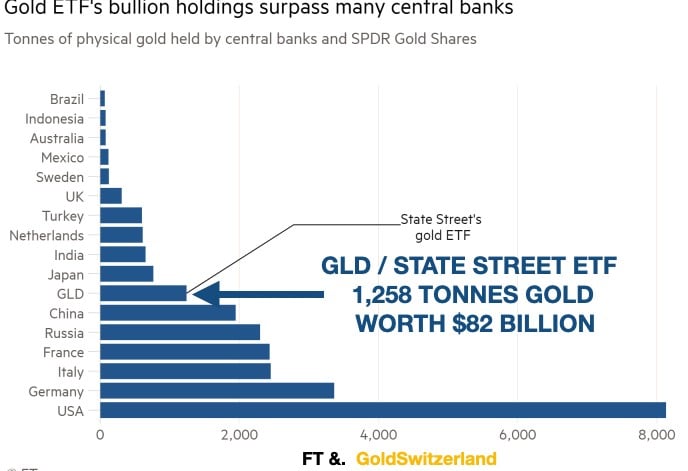

The largest gold ETF is GLD or State Street. At its height, GLD held a total 1,258 tonnes (under 900 tonnes as of this writing) with a value of $82 billion. This made GLD the 7th largest holder of gold in the world.

This ETF is the primary vehicle that investors use when they want exposure to gold. What most investors don’t understand, however, is that to own a gold ETF like GLD is effectively no better than having a futures contract in gold.

Why?

Because GLD, like other gold ETFs, is a tracking vehicle and doesn’t fully own the gold listed under its holdings column. The gold is not bought outright by GLD but is instead borrowed. The holder of a GLD share therefore has no claim on the borrowed gold and hence does not own anything tangible. Instead, the ETF participant holds a piece of paper with no underlying security in the form of physical gold in the event of ETF insolvency.

The ETF’s gold is borrowed or leased from a central bank and not bought with clear title. Of course, such a paper claim on gold is very different from owning genuine physical gold in the manner recommended/described above. In fact, the gold price could surge but the ETF could still go bankrupt.

When an investor in an ETF like GLD buys gold, the gold doesn’t come from the Swiss refiners. Instead, it travels downhill from a daisy-chain of bullion banks who borrowed the gold from a central bank. Yes, the GLD ETF has an official audit with bar lists and numbers. But since central banks never publish a full physical audit, there is no way of ever knowing or verifying if the same gold has been rehypothecated several times by the central bank, which we know is the case.

In sum, the ETF doesn’t own the gold outright and even the gold that it doesn’t own might have been lent multiple times by central banks.

Gold ETF’s–Extreme Counterparty Risk

One of the major advantages with owning segregated physical gold (as opposed to “ETF gold”) is that it is the only asset which is not someone else’s liability. But buying a gold ETF like GLD involves multiple counterparty risks with no ownership of the underlying metal.

For example, investors in GLD or other similar vehicles, buy shares in the fund’s trustee, in this case, the SPDR Gold Trust. The custodian of the gold is HSBC, who sources and stores the gold for the Trust. This obviously makes HSBC a major counterparty and hence risk— as any who tracks the extraordinary risks in the banking sector in general (or HSBC in particular) would and should know.

But the risks do not end there. HSBC also uses sub-custodians, other bullion banks and even the Bank of England to source and store the gold. This means that ETF investors are subject to additional and multiple levels of sub-custodian risk.

Furthermore, there are no contractual agreements between the Trustee and the sub-custodians or the custodian. This means that the ability of the trustees or the custodian to take legal action against the sub-custodians is limited. The Trustee is not insured. That is left to the custodians. Gold held in the Trust’s unallocated gold account is not segregated from the custodian’s assets. If a custodian becomes insolvent, its assets may not be adequate to satisfy the claim of the trust.

The foregoing risk factors for ETF gold “ownership” are clear and shall hopefully serve to enlighten otherwise prospective gold ETF investors toward physical rather than paper gold. ETF vehicles like GLD are far better suited as a vehicle of choice for traders and speculators rather than informed, long-term precious metal investors who recognize and understand gold’s historical and now timely role as a wealth preservation asset.

For wealth preservation investors, ETF vehicles like GLD do not satisfy any of the criteria of holding a reserve asset like gold totally risk free.

To summarize, the primary problems with buying gold through an ETF vehicle are the following:

- It is a paper security held within the financial system

- It has multiple counterparty risk

- The gold holdings are not segregated from custodians’ assets

- It owns no gold directly

- The gold is stored within the banking system

- The gold held is probably rehypothecated

- The gold is not fully insured

- Investors have no access to their gold

In short, and to repeat, holding gold through an ETF vehicle is effectively no better than holding gold futures contracts rather than actual gold. For wealth preservation purposes, gold must be held outside the banking system in the safest private vaults in the world. The gold must be controlled directly by the investor with direct access to their gold in the vault. No other party must be allowed to touch this gold without owner authorization.

Final Thoughts

Despite a long history of client mismanagement (deposit freezes, illiquidity, non-transparency, counterparty risk, operational failures, “tainted” assets, bank emergencies, changing regulations etc.) and the open systemic distortions in the global financial system, traditional bullion banks remain the go-to-choice for many bullion owners and ETF vehicles for no other reason than they “trust the TBTF names.”

Naturally, this perplexes but does not surprise us. Pack-thinking, even among bank clients and ETF sponsors, is nothing new.

Should the major global banks experience another “emergency,” no one can foresee its length or depth with certainty, but what we can say with certainty is that the banks will own these bullion assets ahead of their customers—and will do their best to hold (restrict) the precious metals for as long as they can, as that… after all, is what banks do.

What will the tomorrow’s banking rules be? How long will the next “emergency” last? What liquidity limits will be imposed? Will delivery be partial or full? No one can predict the next catalyst of the next banking crisis, which are the very reasons informed investors invest in gold. As veteran market experts with a long personal and professional experience with global banks, we can confirm that global banking risks have never been higher than they are today.

Given these facts, why would any serious gold investor hold his/her precious metals within the very system against which their metals were acquired to protect them?

For those wishing to avoid such known and unknown risks, the clear path forward is one that leads investors away from commercial bullion banking pitfalls and toward the most transparent and trusted private vault services in the safest jurisdictions. Core assets like physical gold and silver must be given the greatest attention and protection, something which commercial banks have historically failed to deliver. The burden is therefore on the informed and sophisticated precious metal investor to vet and engage the world’s premier vaulting facilities in the safest, wealth-friendly and politically stable jurisdictions.