Why Own Gold?

First, The Problem: An Undeniable Currency/Wealth Crisis & Transformation

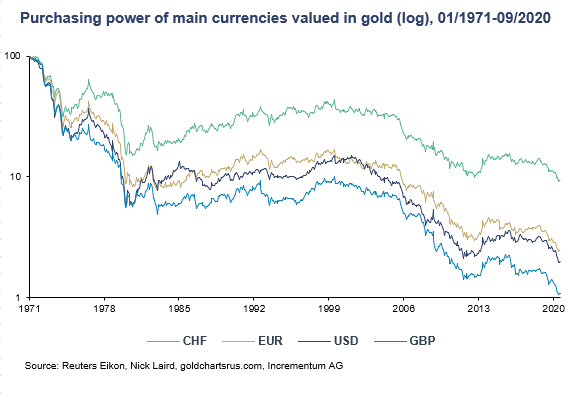

Fiat currencies are openly entering the last chapters of their once illusory but now steadily declining purchasing power and global credibility.

La plus ca change…

This slow and steady spiral of fiat currency strength and the consequent risk of wealth destruction is nothing new.

In fact, all debt-soaked systems throughout history have ended with a debased and then broken fiat currency. This is true without exception—from Ancient Rome to the Modern West.

Today’s global currencies are empirically following the same familiar pattern.

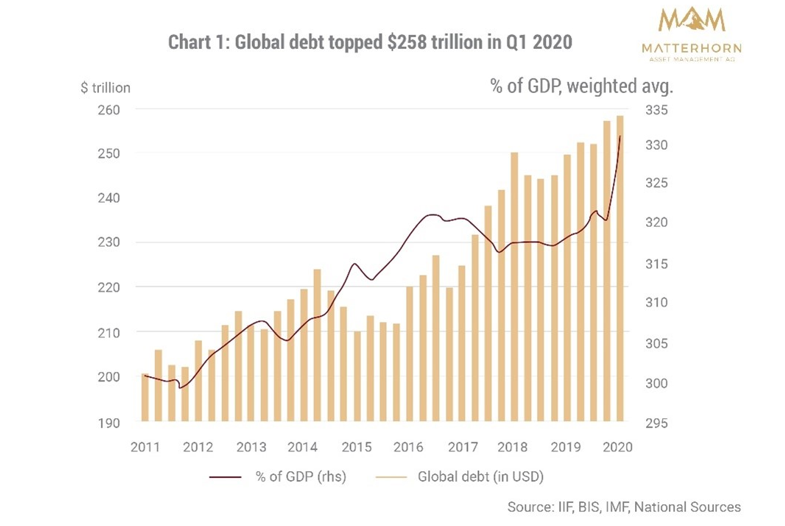

In a global setting of unprecedented (and rising) debt levels which have risen from $258 trillion in 2020 to well over $300 trillion by 2022…

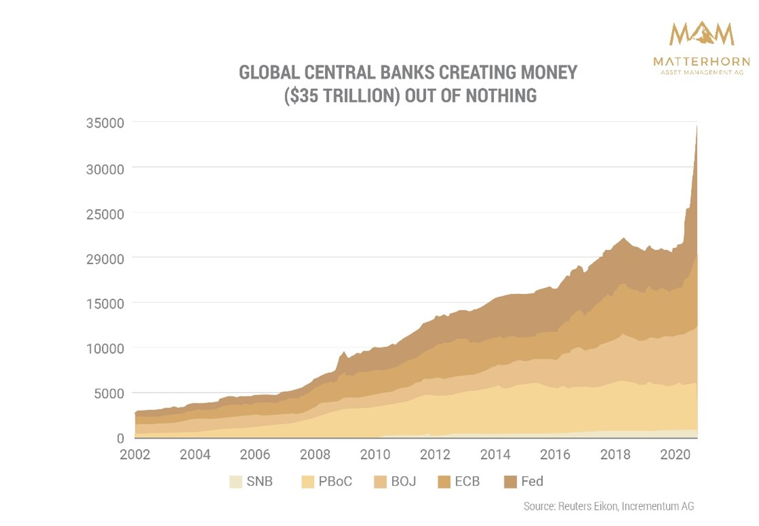

… these debts have been dangerously monetized (i.e., “paid” for) by years of equally unprecedented levels of mouse-click currencies “printed” by global central banks:

This extreme monetary expansion has made informed investors increasingly aware that such policies (and banks) have collectively driven the world into a recessionary new direction marked by persistent rather than transitory inflation. Measured against a milligram of gold, the purchasing power of the major currencies of the world have fallen by greater than 95% since Nixon removed the world reserve USD from its gold-backing in 1971.

In the near future, global markets and currencies (as well as those who use them) will become increasingly controlled/centralized as Central Bank Digital Currencies (likely to be backed by a partial gold coverage) replace discredited paper money with surveillance-enabled digital currencies, i.e., the E-Yen, E-Euro, E-Dollar etc.

The IMF telegraphed/confessed this new, inevitable and most-likely disorderly “CBDC” direction in 2020 when blaming a mis-managed pandemic (rather than years of central bank exigence) for the crippling debt and inflationary forces already in motion. The BIS and US Federal Reserve have made similar announcements in 2021 and 2022.

The foregoing and converging facts point once more to precious metals as an essential wealth preservation asset.

Next, the Solution: The Historical & Re-Emerging Role of Precious Metals

Each of the foregoing factors has compelled informed investors to recognize the historical role of physical precious metals as a wealth-preserving insurance asset against empirically objective risks of currency, and hence wealth, destruction.

In short: Owning physical gold and silver is a critical risk-management allocation rather than theoretical debate.